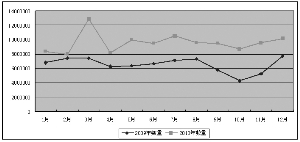

Quantity such as off the wild Mustang surged in prices such as free fall According to statistics from the Customs, in 2010, China exported a total of 114,700 tons of vitamin C, a year-on-year increase of 46.87%. From January to February of this year, it exported 20,500 tons, an increase of 25.45% year-on-year. Since the end of 2009, the National Development and Reform Commission and the Ministry of Industry and Information Technology have investigated the serious overcapacity in the Vitamin C industry, and plan to rectify the situation with heavy punches. In just over a year, China’s vitamin C export volume has exploded. 40,000 tons, equivalent to half of the normal annual shipments. The average export price has been decreasing month by month. The average price in 2010 was only US$6.96/kg, which was a decrease of US$3.18 per kg from 2009, a year-on-year decrease of 31.36%; the average price of vitamin C exports from January to February 2011 was only US$5.53. /kg, a year-on-year decrease of 36.83%. Incremental Price Increases Cause Market Panic At the beginning of 2010, due to the overcapacity in the domestic market, China's vitamin C export prices have dropped significantly, and the unit price fell below the US$9/kg mark for the first time. In the first half of the year, prices were barely above US$8/kg, and the overall trend was steady declines. In June, vitamin C products from domestic expansion and re-establishment companies began to surface in succession, and the industry's eagerly awaited industry rectification policies have not yet been watched. As a result, domestic production companies and foreign customers have become panicked and vitamin C prices have once again begun to avalanche. In the first half of the year alone, total exports increased by 16,000 tons, which is equivalent to two months of export volume (see Figure 1). In the second half of the year, the export price of vitamin C showed a free fall. By the end of the year, the price of the vitamin C industry had stopped falling and showed some signs of recovery (see Figure 2). While the use of prices by foreign middlemen is at a low point, and a large number of stocks have started, from the perspective of customs statistics, the number of vitamin C exports in the second half of last year increased by more than 20,000 tons over the same period. Figure 1: Trend of monthly export volume of vitamin C in 2010 Figure 2: Trends of monthly export prices of vitamin C in 2010 From the export market, China's vitamin C exports to 122 countries and regions in 2010, an increase of 8 emerging markets over the previous year. The EU, North America, and Asia are still the main markets for exports, with a proportion of 87.01% (see Figure 3). Of the 36,600 tons of vitamin C with a year-on-year increase in exports in 2010, 65% (about 24,000 tons) were exported to Europe and America. Asia region. The number of exports to major export markets and emerging markets grew rapidly, with the EU increasing by 47.9%, North America by 38.66%, and Asia by 43.4%; some emerging markets such as the Middle East, Africa, and Latin America saw export growth exceeding the average, at 91.98, respectively. %, 83.53%, and 68.3%. In the latter three regions, although the number is growing rapidly, the average export price is relatively low. For example, the average export price in Latin America is only US$6.19/kg. The regions with relatively higher export prices were Oceania and Asia, which were US$7.75/kg and US$7.72/kg, respectively. The top ten destination countries for vitamin C exports in China in 2010 were the United States, Germany, Japan, Belgium, the Netherlands, Brazil, Italy, the United Kingdom, South Korea, and Indonesia. Last year, China’s exports to the above-mentioned ten countries all increased at different levels. The largest increase was in Italy, which was a year-on-year increase of 97.27%, followed by Germany, which was a year-on-year increase of 67.21%. The smallest increase was in the United Kingdom, which was a year-on-year increase of only 0.63%. It can be seen that the market pattern of vitamin C has not changed and the demand in the mainstream market remains strong. Emerging markets such as Chile, Turkey, Russia, and Nigeria enjoyed good growth, with export growth above 100%. Compared to the increase in the quantity, the export price of vitamin C has been falling all the way. In the top 20 export rankings, the export prices have fallen by more than 26%, of which the export prices to India have fallen by a large margin, reaching 46.86%. In January-February 2011, the EU and Asian markets continued to maintain a rapid growth of 45.51% and 47.97%, while the US market tended to be stable with an increase of only 1.94%. Figure 3: Distribution of vitamin C exports in 2010 The main company should be wary of trouble As one of the few products in China that have independent intellectual property rights and have the right to speak in the international market, China's vitamin C production technology is advanced, the scale of the device is large, the industrial concentration is high, and the competitiveness is strong. At present, the global vitamin C production capacity is highly concentrated, there are six major suppliers, in addition to the Netherlands DSM's Darryl plant in Scotland has 23,000 tons of production capacity, the remaining production capacity is mainly concentrated in China's Northeast Pharmaceutical Group and other five major manufacturers. Vitamin C is an export-oriented product of China's pharmaceutical industry. Therefore, domestic production enterprises are also the main force for foreign trade exports. Among the top ten vitamin C export rankings, eight are vitamin C and its derivative producers, and two are bonded area companies. In 2010, there were 206 vitamin C export companies in China, an increase of 32 over the previous year. The share of the top ten companies in export volume in 2010 was 93.96%, a decrease of 2.61 percentage points from 2009. In 2010, China's Vitamin C exports to the US market ranked the top five companies: Zibo Luwei, Weisheng Pharmaceutical, Jiangshan Pharmaceutical, Northeast Pharmaceutical and North China Pharmaceutical. Among them, the market share of Zibo Luwei increased significantly. In 2010, the export volume accounted for nearly 5 percentage points more than the increase in 2009. (See Figure 4) Figure 4: Market Segmentation of Vitamin C for U.S. Export Enterprises in 2010 In 2010, the top five companies in China's Vitamin C exports to the German market were: North China Pharmaceuticals, Zibo Luwei, Northeast Pharmaceuticals, Weisheng Pharmaceutical, and Jiangshan Pharmaceutical. Among them, the market share of Jiangshan pharmaceuticals has fallen by a large margin. In 2010, the export volume accounted for nearly 7 percentage points less than in 2009. (See Figure 5) Figure 5: Market Segmentation of Vitamin C for German Export Companies in 2010 In 2010, China's Vitamin C exports to the Japanese market ranked the top five companies: Weisheng Pharmaceutical, Jiangshan Pharmaceutical, Northeast Pharmaceutical, North China Pharmaceutical, and Tianjin Mattel Industrial Development Co., Ltd. Among them, the market share of pharmaceuticals in North China has fallen by a large margin. In 2010, the export volume accounted for nearly 8 percentage points less than in 2009. (See Figure 6) Figure 6: Market Segmentation of Vitamin C Exported to Japan in 2010 It is reported that the National Development and Reform Commission and the Ministry of Industry and Information Technology have already identified 10 domestic vitamin C manufacturers as compliant companies. However, due to the fact that no relevant regulatory implementation rules have yet been promulgated, the so-called compliance and non-compliance companies are still competing against each other in time and market. Already in a highly saturated state, new price wars may break out at any time. The author is worried that excessive exports within a certain period of time can easily attract foreign anti-dumping lawsuits. If unfortunately, there are anti-monopoly cases before the conclusion of anti-dumping charges, China's vitamin C industry will be in a dilemma. Disposable Long Arm Transparent Veterinary Gloves Disposable Transparent Veterinary Gloves,Custom Disposable Long Arm Gloves,Transparent Veterinary Glove,Long Arm Length Plastic Gloves Jinan Mucho Commercial Inc. , https://www.muchovet.com